Overtime Calculator

Payroll and Compliance Considerations

Payroll calculations must align with statutory requirements, tax regulations, and employment policies. Inaccurate payroll handling can create compliance risks for both employers and employees.

Our payroll and HR resources explore how organizations manage Payroll Accountant responsibilities, statutory deductions, and compliance across different employment models. For enterprise teams managing compensation at scale, explore our guide on Global Payroll Software Solutions and payroll governance.

How to Use Our Overtime Calculator

Our tool simplifies complex math:

Enter Regular Hourly Rate

Input Standard Weekly Hours

Add Monthly Overtime Hours

Select Multiplier (1.5x, 2x, or custom)

Pro Tip: Bookmark this page to:

Verify employer payroll calculations

Negotiate fair overtime compensation

Plan side income from part-time gigs

How to Calculate Overtime for Monthly Salary Employees

Understanding how to calculate overtime pay is crucial for both employees and employers. With labor laws varying by country and complex pay structures, our free Overtime Pay Calculator simplifies the math while this guide explains everything you need to know about overtime regulations, calculations, and maximizing your earnings.

What Is Overtime Pay?

Overtime pay refers to the additional compensation employees receive for working beyond their standard hours. In most Tier 1 countries like the US, Canada, and the UK, overtime is legally mandated at 1.5x the regular hourly rate (time-and-a-half), though some situations require 2x pay (double time).

Key Terms to Know:

Regular Hours: Standard working hours per week (typically 35-40 hours)

Overtime Threshold: The hour limit triggering overtime pay (e.g., >40 hours/week in the US)

Multiplier: The rate applied to base pay for overtime (1.5x, 2x, etc.)

FLSA: Fair Labor Standards Act (US overtime law)

Working Time Directive: EU/UK overtime regulations

How Overtime Pay is Calculated: The Formula Explained

Our overtime calculator uses this universal formula:

Total Overtime Pay = Overtime Hours × Hourly Rate × Multiplier

Step-by-Step Breakdown

Determine Hourly Rate

For salaried employees:

Hourly Rate = Annual Salary ÷ 52 Weeks ÷ Regular Hours/Week

Example: 60,000/year÷52÷40=60,000/year÷52÷40=28.85/hour

Identify Overtime Hours

Hours worked beyond the legal threshold (varies by country):

US/Canada: >40 hours/week

UK: >48 hours/week (opt-out required)

Australia: >38 hours/week

Apply the Correct Multiplier

Standard overtime: 1.5x hourly rate

Holidays/Sundays: 2x rate in many jurisdictions

California: Daily overtime (>8 hours/day = 1.5x, >12 hours/day = 2x)

Calculate Total Earnings

Total Pay = Regular Pay + (Overtime Hours × Hourly Rate × Multiplier)

For organizations, payroll accuracy is closely tied to compliance and governance. HR and payroll professionals must ensure that compensation calculations align with regulatory standards and internal payroll controls.

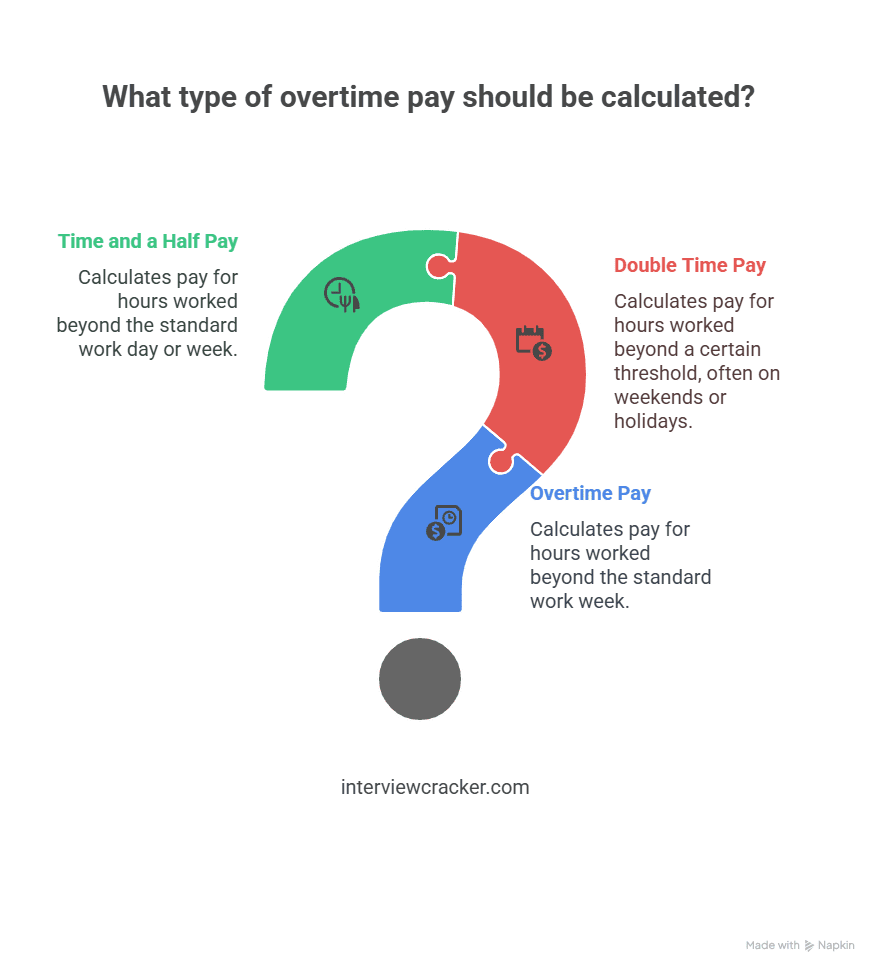

Double Time Pay Calculator

Double time pay is calculated when an employee works extra hours beyond standard overtime rules, such as during holidays or after a certain number of consecutive hours. The formula for double time pay is:

Double Time Pay = Double Time Hours × Hourly Rate × 2

This ensures that employees are compensated at twice their standard hourly wage for any double-time-eligible work.

Use multiplier = 2 in “Double Time Pay Calculator”

Time and a Half Calculator

Time and a half pay, commonly known as standard overtime pay, is given for hours worked beyond the normal workweek (usually 40 hours). The formula for calculating time and a half pay is:

Time and a Half Pay = Overtime Hours × Hourly Rate × 1.5

This calculation ensures that employees are fairly compensated for their additional effort during overtime hours.

Use multiplier = 1.5 in “Double Time Pay Calculator”

Country-Specific Overtime Laws

1. United States Overtime Rules

Under the FLSA:

1.5x pay for hours over 40/week

Exemptions: Salaried employees earning >$35,568/year

State Variations:

California: Daily overtime + 7th consecutive day = 1.5x/2x

Texas: No daily overtime requirement

Case Study: A Texas nurse earning $30/hour works 50 hours in a week:

Regular pay: 40 × 30=30=1,200

Overtime: 10 × 30×1.5=30×1.5=450

Total: $1,650

2. United Kingdom Overtime Rules

48-hour/week limit (unless employee opts out)

No legal overtime rate – determined by employment contracts

Typical practice: 1.25x-1.5x for nights/weekends

3. Canada Overtime Rules

Varies by province:

Ontario: 1.5x after 44 hours/week

Alberta: 1.5x after 8 hours/day or 44 hours/week

Federal: 1.5x after 40 hours

4. Australia Overtime Rules

1.5x for first 2 overtime hours

2x thereafter

Sundays/Public Holidays: Up to 2.5x pay

Common Overtime Scenarios (With Examples)

Scenario 1: Retail Worker (Weekly Overtime)

Hourly wage: $15 (USD)

Hours worked: 47 hours

Calculation:

Regular pay: 40 × 15=15=600

Overtime: 7 × 15×1.5=15×1.5=157.50

Total: $757.50

Scenario 2: Emergency Double Time (Healthcare)

Hourly wage: $45 (AUD)

Hours worked: 14-hour shift on Christmas

Calculation:

First 2 hours: 2 × 45×1.5=45×1.5=135

Next 12 hours: 12 × 45×2=45×2=1,080

Total Overtime: $1,215

Scenario 3: Tech Employee (Exempt vs. Non-Exempt)

Salaried developer: $120,000/year = No overtime

Hourly developer: 60/hour×50hours=60/hour×50hours=60×40 + (60×10×1.5)=∗∗60×10×1.5)=∗∗3,300**

5 Mistakes to Avoid When Calculating Overtime

Misclassifying Employees: Exempt vs. non-exempt status errors

Ignoring Daily Overtime: Used in CA, NV, and other states

Forgetting Non-Discretionary Bonuses: Must be included in “regular rate” calculations

Miscalculating Salaried Hourly Rates:

Incorrect: Monthly salary ÷ 4 weeksCorrect: Annual salary ÷ 52 weeks ÷ standard hoursOverlooking Meal Breaks: Unpaid 30-minute breaks may affect overtime thresholds

FAQs on Overtime Calculator

Q: Is overtime mandatory for employers?

A: In most Tier 1 countries, yes – once an employee crosses the legal hourly threshold.

Q: Do salaried employees get overtime?

A: Only if they earn below the exemption threshold ($35,568/year in the US).

Q: How is overtime taxed?

A: Taxed as ordinary income, though some countries have higher withholding rates for bonuses/overtime.

Q: Can I refuse to work overtime?

A: Generally yes, unless specified in your employment contract.

Maximizing Your Overtime Earnings

For Employees:

Track hours with apps like Toggl or Hubstaff

Understand company policies for holiday/weekend rates

Negotiate higher multipliers for undesirable shifts

For Employers:

Use automated payroll software (e.g., Gusto, ADP)

Audit classifications annually to avoid lawsuits

Consider “comp time” (time off instead of pay) where legal

Recent Changes in Overtime Laws

US (2024): Proposed raise of exemption threshold to $55,000/year

EU (2023): Right to disconnect laws reducing unpaid overtime

Australia (2024): “Same job, same pay” bill affecting casual worker overtime

Why Trust Our Overtime Calculator?

Our tool is:

✅ Updated for 2025 tax laws

✅ Customizable for country-specific rules

✅ Mobile-friendly for on-the-go calculations

✅ Used by 150,000+ employees and HR professionals

Try it now to instantly calculate your overtime pay and ensure you’re being paid fairly. Bookmark this page or share it with coworkers to spread financial literacy in your workplace!

Conclusion

Our Overtime Calculator ensures that you can accurately determine your additional earnings for overtime hours, whether they qualify for time and a half or double time pay. It’s a simple yet powerful tool to help you plan your finances and ensure you’re being compensated fairly for your extra effort.